Credit Unions in Wyoming: Comprehensive Banking Solutions and Participant Conveniences

Credit Unions in Wyoming: Comprehensive Banking Solutions and Participant Conveniences

Blog Article

Elevate Your Banking Experience With Lending Institution

Checking out the world of financial experiences can often lead to finding hidden gems that use a rejuvenating departure from standard banks. Credit report unions, with their focus on member-centric services and neighborhood participation, present an engaging choice to conventional financial. By focusing on specific needs and fostering a feeling of belonging within their subscription base, lending institution have actually carved out a niche that reverberates with those looking for a more tailored technique to handling their finances. Yet what sets them apart in terms of boosting the banking experience? Let's dive deeper right into the unique advantages that credit scores unions offer the table.

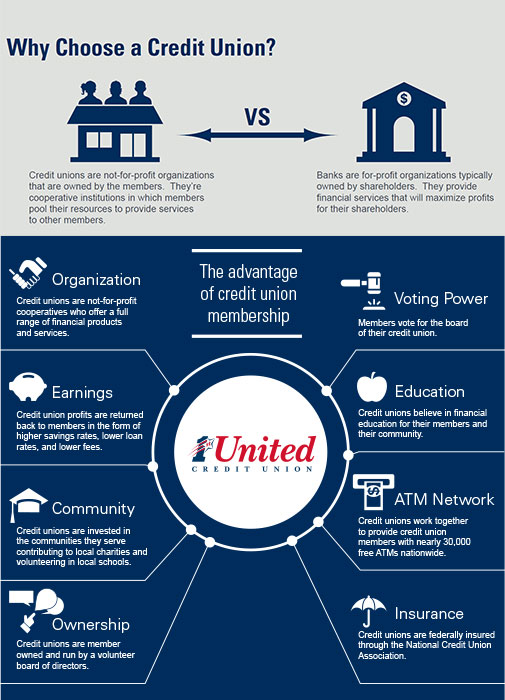

Advantages of Cooperative Credit Union

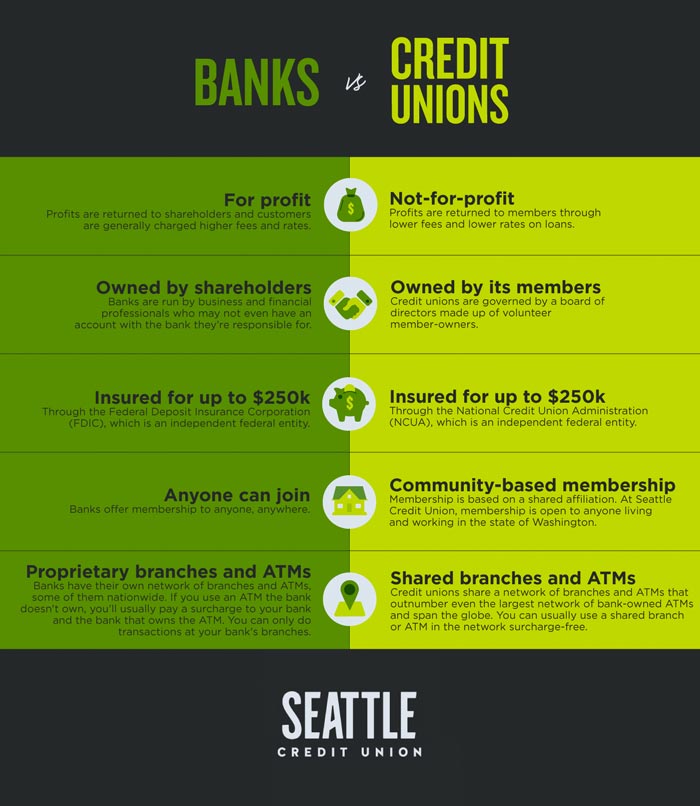

Providing a series of financial services customized to the requirements of their participants, lending institution supply countless benefits that establish them apart from traditional banks. One essential advantage of cooperative credit union is their concentrate on community involvement and participant contentment. Unlike banks, credit unions are not-for-profit companies had by their participants, which often brings about reduce costs and much better rate of interest on interest-bearing accounts, car loans, and bank card. In addition, lending institution are recognized for their customized customer support, with staff members making the effort to understand the unique financial objectives and challenges of each member.

An additional advantage of lending institution is their democratic framework, where each member has an equivalent vote in choosing the board of supervisors. This guarantees that decisions are made with the most effective interests of the participants in mind, as opposed to concentrating exclusively on making best use of profits. Credit scores unions usually offer economic education and learning and therapy to assist participants improve their financial literacy and make notified choices concerning their money. Generally, the member-focused strategy of lending institution sets them apart as establishments that focus on the wellness of their neighborhood.

Subscription Requirements

Some credit report unions may offer people that live or work in a particular geographic location, while others may be associated with certain business, unions, or organizations. In addition, household members of existing credit scores union participants are often qualified to sign up with as well.

To end up being a participant of a lending institution, people are usually called for to open an account and preserve a minimal deposit as defined by the institution. Sometimes, there may be one-time subscription costs or ongoing subscription fees. As soon as the membership requirements are fulfilled, individuals can delight in the benefits of coming from a debt union, including access to personalized financial services, competitive rate of interest, and a focus on participant complete satisfaction.

Personalized Financial Providers

Personalized financial services tailored to private demands and choices are a trademark of cooperative credit union' dedication to participant contentment. Unlike traditional financial institutions that typically offer one-size-fits-all services, credit report unions take an extra tailored approach to managing their participants' funds. By recognizing the unique objectives and circumstances of each member, lending institution can supply tailored recommendations on savings, investments, fundings, and other economic products.

Credit history unions focus on developing solid partnerships with their participants, which enables them to provide personalized solutions that surpass simply the numbers. Whether somebody is saving for a certain goal, preparing for retirement, or seeking to boost their credit rating, cooperative credit union can produce personalized monetary plans to assist members attain their goals.

Furthermore, cooperative credit union commonly offer reduced charges and affordable rate of interest rates on finances and cost savings accounts, further boosting the individualized economic services they supply. Wyoming Federal Credit Union. By concentrating on specific requirements and supplying customized remedies, lending institution set themselves apart as trusted monetary partners devoted to aiding participants flourish economically

Neighborhood Involvement and Assistance

Area involvement is a foundation of credit unions' objective, mirroring their dedication to sustaining regional campaigns and fostering meaningful links. Lending institution actively get involved in neighborhood events, sponsor neighborhood charities, and arrange economic literacy programs to inform non-members and participants alike. By investing in the communities they offer, cooperative credit union not just reinforce their connections but likewise add to the general wellness of culture.

Supporting tiny organizations is one more means lending institution demonstrate their dedication to neighborhood communities. Through providing bank loan and monetary suggestions, credit history unions assist business owners flourish and boost economic growth in the location. This support exceeds simply monetary aid; lending institution commonly provide mentorship and networking possibilities to assist local business prosper.

In addition, credit score unions often engage in volunteer job, encouraging their workers and members to provide back through various area service tasks. Whether it's taking part in neighborhood clean-up events or organizing food drives, lending institution play an energetic duty in enhancing the lifestyle for those in need. By prioritizing neighborhood involvement and assistance, lending institution genuinely embody the spirit of collaboration and mutual aid.

Electronic Banking and Mobile Applications

Mobile apps supplied by credit history unions even more enhance the financial experience by giving added adaptability and accessibility. Members can carry out different banking jobs on the go, such as depositing checks by taking a picture, receiving account notices, and also calling client support straight via the app. The safety of these mobile apps is a top priority, with functions like biometric authentication and security procedures to secure delicate information. On the whole, credit history unions' electronic banking and mobile applications equip members to manage their funds effectively and safely in today's fast-paced electronic globe.

Conclusion

In verdict, credit unions use a special financial experience that focuses on area involvement, personalized solution, and participant fulfillment. With lower charges, competitive interest prices, and tailored financial services, credit history unions cater to specific requirements and advertise economic wellness.

Unlike financial institutions, credit unions are not-for-profit organizations possessed by their participants, which typically leads to lower fees and much better interest prices on cost savings accounts, car loans, and credit history cards. Additionally, credit score unions are recognized for their personalized consumer solution, with team members taking the time to understand the distinct monetary objectives and challenges of each participant.

Report this page